|

||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

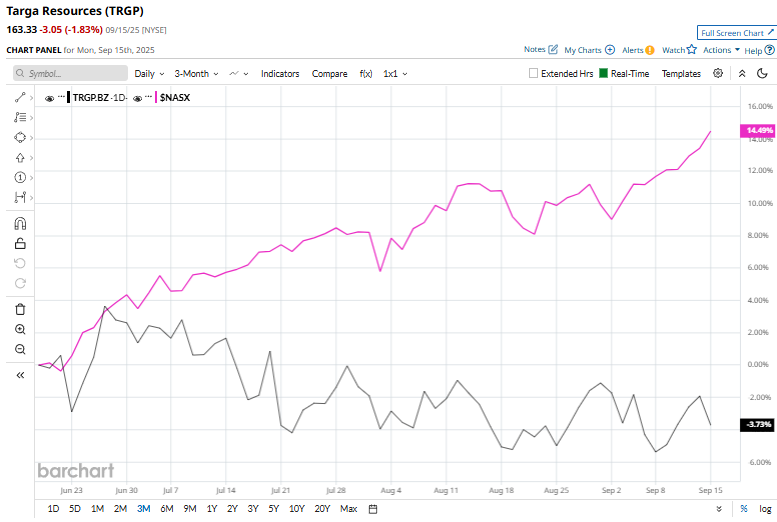

Is Targa Resources Stock Underperforming the Nasdaq?

Based in Houston, Texas, Targa Resources Corp. (TRGP) is a leading U.S. midstream energy company operating through its Gathering & Processing and Logistics & Transportation segments. Valued at a market cap of $35.8 billion, the company also offers NGL balancing services and transportation services to refineries and petrochemical companies. Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and TRGP fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the oil & gas midstream industry. The company benefits from fee-based contracts that reduce exposure to commodity price swings, while ongoing expansion projects in processing and fractionation enhance growth potential. Its scale, integrated asset network, and export capabilities at Mont Belvieu and Galena Park position it to capitalize on rising global demand for natural gas and LPG. However, shares of this energy company are currently trading 25.3% below its 52-week high of $218.51, reached on Jan. 22. Shares of TRGP have fallen 6.6% over the past three months, underperforming the broader Nasdaq Composite’s ($NASX) 15.2% rise over the same time frame.  In the longer term, TRGP has rallied nearly 10.2% over the past 52 weeks, trailing $NASX’s 26.4%. Moreover, on a YTD basis, shares of TRGP are up 8.5%, compared to $NASX’s 26.4% rise. TRGP has been trading below its 50-day and 200-day moving averages since April, indicating a bearish trend.  On Aug. 7, TRGA shares rose 2.4% after the company released its second-quarter earnings. Its revenue posted a 20% year-over-year to $4.26 billion, fuelled by higher NGL volumes and stronger natural gas prices. Net income attributable to common shareholders more than doubled to $629.1 million from $298.5 million in the prior year. Its adjusted EBITDA rose 18% to $1.16 billion, supported by record Permian throughput and robust NGL transportation volumes. Looking ahead, the company reaffirmed its full-year 2025 adjusted EBITDA guidance of $4.65–$4.85 billion, citing expected growth in its Permian gathering and processing operations, with new records anticipated across production, NGL pipelines, fractionation, and LPG exports, building on 2024’s highs. TRGP has surpassed its key rival, Enterprise Products Partners L.P. (EPD), which gained 7.2% over the past 52 weeks and 1.2% on a YTD basis. The stock has a consensus rating of “Strong Buy” from the 21 analysts covering it, and the mean price target of $205.14 suggests a 25.6% premium to its current levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|