|

||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is T. Rowe Price Group Stock Underperforming the S&P 500?/T_%20Rowe%20Price%20Group%20Inc_%20phone%20and%20stock%20info-by%20Rokas%20Tenys%20via%20Shutterstock.jpg)

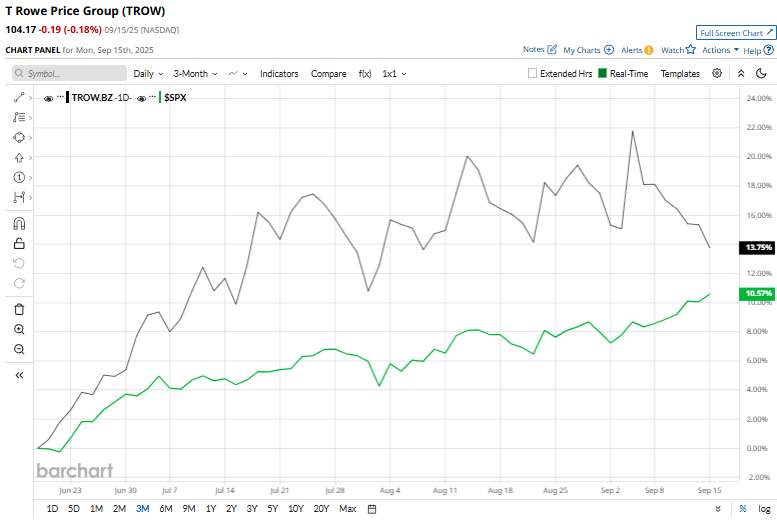

T. Rowe Price Group, Inc. (TROW), with a market cap of $20.5 billion, is a leading global investment management firm headquartered in Baltimore, Maryland. The company offers a wide range of products and services, including mutual funds, sub-advisory mandates, separate account management, retirement solutions, and advanced planning tools for both individuals and institutions. Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and TROW fits the label perfectly. TROW stands out for its scale, influence, and established reputation in the asset management space. Its investment philosophy is rooted in disciplined, research-driven active management, supported by a blend of in-house and external research. Despite the notable strengths, shares of the asset management company have dipped 17.2% from its 52-week high of $125.81, reached on Dec. 6, 2024. Shares of TROW have gained 13.8% over the past three months, surpassing the S&P 500 Index ($SPX), which has returned 10.7% over the same time frame.  In the longer term, TROW has declined marginally over the past 52 weeks, considerably lagging behind the S&P 500’s 17.6% rise over the same time frame. Moreover, on a YTD basis, shares of TROW are down 7.9%, compared to $SPX’s 12.5% return. TROW has been trading above its 200-day moving average since mid-July and has slipped below its 50-day moving average in the last trading session.  On Sept. 4, shares of T. Rowe Price Group jumped over 5% after The Goldman Sachs Group, Inc. (GS) announced plans to invest up to $1 billion in the firm and partner with it to expand private-market offerings for retail investors. TROW’s underperformance looks pronounced when compared to its rival, BlackRock, Inc.’s (BLK) 25.9% gain over the past 52 weeks and 8.8% rise on a YTD basis. The stock has a consensus rating of "Moderate Sell” from the 14 analysts covering it, and it currently trades above the mean price target of $93.21. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|