|

||

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Fortive Stock Underperforming the Dow?/Fortive%20Corp%20logo%20magnified-by%20Postmodern%20Studio%20via%20Shutterstock.jpg)

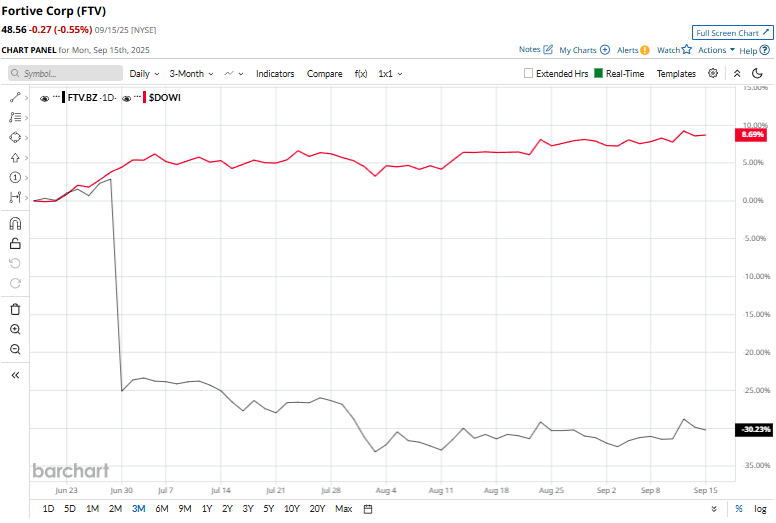

Valued at a market cap of $16.5 billion, Fortive Corporation (FTV) is a diversified industrial technology company that designs, develops, manufactures, and services professional and engineered products, software, and services. The Everett, Washington-based company offers connected workflow solutions that include professional instrumentation, industrial automation, sensing, analytics software, and healthcare workflow tools under notable brands such as Fluke, Tektronix, Accruent, ServiceChannel, and Landauer. Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and FTV fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the scientific & technical instruments industry. Its portfolio includes well-known brands like Fluke, Industrial Scientific, Accruent, and Gordian, with offerings spanning industrial safety, productivity software, facility management, and healthcare compliance solutions. This tech company has dipped 41.7% from its 52-week high of $83.32, reached on Feb. 20. Shares of Fortive have plunged 30.1% over the past three months, significantly lagging behind the broader Dow Jones Industrial Average’s ($DOWI) 8.7% rise during the same time frame.

In the longer term, FTV has declined 34% over the past 52 weeks, underperforming $DOWI’s 10.9% rise over the same time frame. Moreover, on a YTD basis, shares of FTV are down 35.3%, compared to $DOWI’s 7.9% uptick. FTV’s downtrend is reinforced by its technical indicators, with the stock trading below its 200-day moving average since early March and remaining below the 50-day moving average since late June.

On July 30, Fortive shares tumbled 2.5% after the company released its second-quarter results. It reported revenue of about $1.02 billion from continuing operations, down slightly year-over-year, with core revenue slipping marginally. Despite the modest sales decline, profitability remained steady as adjusted EPS improved to $0.58 from $0.56 in the prior year. However, Fortive has lagged behind its rival, Cognex Corporation (CGNX), which surged 14.2% over the past 52 weeks and 23.2% on a YTD basis. The stock has a consensus rating of "Hold” from the 19 analysts covering it, and the mean price target of $56.50 suggests a 16.4% premium to its current price levels. On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|